On Wednesday, the Nome Common Council, sitting as the Board of Equalization, changed the dates for hearing the first of 169 appeals to property assessment values.

Testimony from appellants was originally scheduled to be heard for three days, starting May 3. The board will now meet May 31 through June 2 at 5:30 p.m. to take up the appeals.

Nome Mayor John Handeland explained why the extra time is needed, saying neither the city nor the appraiser has had time yet to review the appeals.

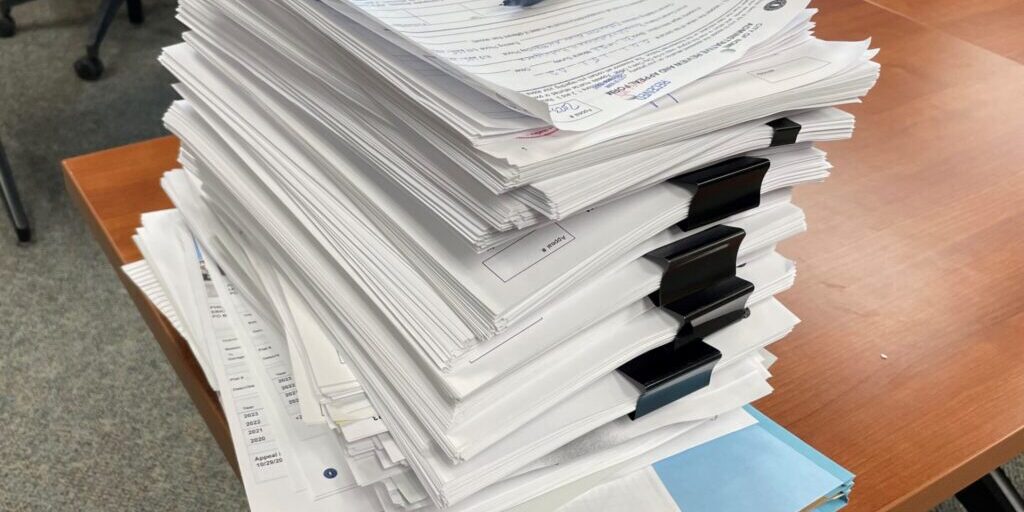

“With 169 appeals, this much paper, they haven’t had a chance to go through it all and neither have we,” Handeland said. “As a result, we are going to … recess this meeting and reschedule it, so that we have an opportunity to hopefully have more of these items gone through between the assessors and the taxpayers.”

Nearly every appeal cited a large increase in property valuations – even if no improvements had been made since 2022. The filing period for appeals ended Friday, April 28.

Handeland added that the city usually only receives a handful of appeals – and that board meetings have been cancelled in the past because there has been no need to convene based on the number of appeals received.

Arne Erickson is a municipal appraiser with Alaska Appraisal Company, the firm that is contracted by the city to perform assessments. He says it wouldn’t be fair to appellants if his company doesn’t get a chance to review their claims.

“My feeling is everybody has a right to be heard,” Erickson said. “If you need inspection or anything like that you certainly have the right and opportunity, and we’re going to give you that.”

Erickson says the appeals process is the correct channel for property owners, given the nature of how Alaska Appraisal Company makes its assessments.

“We don’t have the opportunity to go to every door and speak to everybody in the fall as we do assessments,” Erickson said. “So, that’s the merit of the appeal process. This is a time when you point out ‘here’s everything that’s wrong with my property’ or why it doesn’t fit in to a 15 percent increase.”

In March, the Nome City Clerk’s office mailed out the new assessment values of properties owned in the city. Assessments are conducted during the fall before each tax year. If a property owner disagreed with the amount the assessor has set for their property, they were able to file a written appeal with the Nome City Clerk’s office.

Property taxes are calculated by multiplying the millage rate by the assessed value of the property. Nome’s current property tax rate is 12 mills, which means property owners pay $12 for every $1,000 of assessed value.

In recent council meetings, Nome City Manager Glenn Steckman has suggested that he will seek a lower millage rate when the council meets on May 22. The first reading of the city’s forthcoming budget is also set for that day.

Image at top: More than 1,000 pages of assessment appeals and supporting documentation are being reviewed by the city’s assessors. Photo by Greg Knight/KNOM